NEWS

AMEx CORPORATE UPDATE

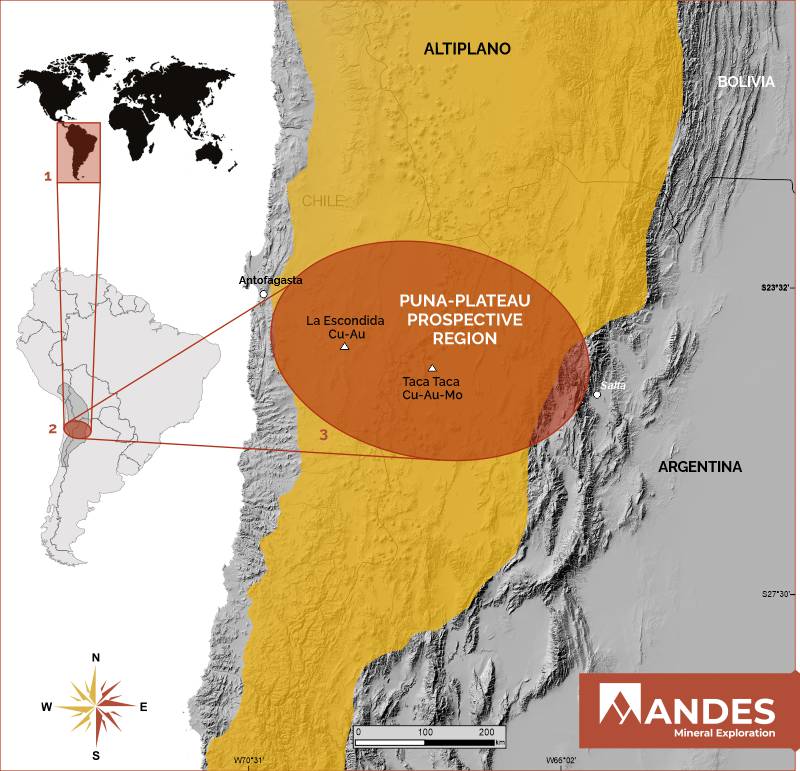

Salta Capital, Salta Province– May 21, 2021 – Andes Mineral Exploration S.A. (“AMEx” or the “Company”) is a Salta-based prospect generator and exploration company offering highly prospective lithium, copper, and gold assets in the prolific Central Andes for investors and venture partners. AMEx is pleased to provide an initial corporate presentation outlining various business matters and objectives relevant for the coming exploration seasons of “Puna Plateau Prospective Region”.

Origins

Andes Mineral Exploration S.A. was incorporated in the City of Salta, Province of Salta, Argentina in 2016 as Alba Argentina Lithium S.A. with the purpose of operating in the “Lithium Triangle” as the subsidiary to a TSX-V listed junior exploration company.

In 2017, the Argentine entity rebranded into AMEx and shifted to operate independently as a business Startup. In 2018, the company was entirely converted into a prospect generator focusing mainly on lithium, copper and gold opportunities in Salta, NW Argentina.

Today, AMEx is looking into expanding its acquisition and exploration efforts around the “Puna Plateau Prospective Area”. An exploration and investment thesis that spans over two tier-one mining Jurisdictions in South America: Salta (Argentina) and Chile.

To date, the company has acquired and optioned out more than 10,000 hectares of prospective exploration and mining rights. Proceeds from property transactions are used to acquire, explore and develop high-quality precious, base and battery metals prospects in the “Puna Plateau Prospective Area”.

The “Thesis”

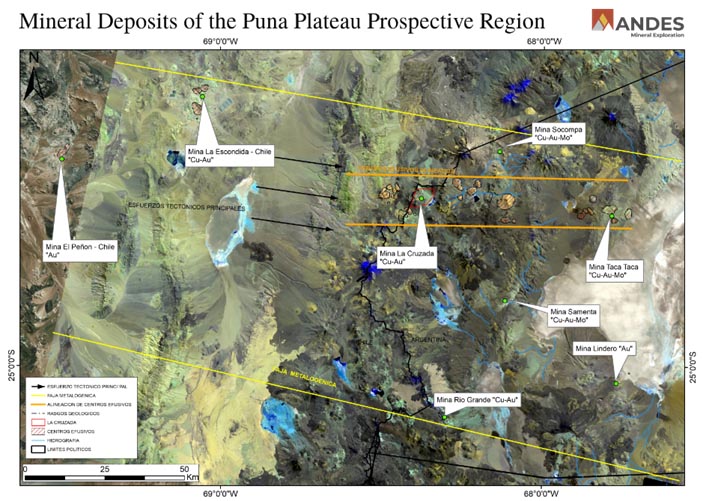

AMEx’s strategic investment thesis is centered in what we call ”The Puna Plateau Prospective Region”. From a generative point of view, that region corresponds to the relatively underexplored Puna Plateau – a southeastern extension of the well-explored Central Andes – which represent one of the richest Cu-Mo-Au provinces in the world, being also host to the so-called “Lithium Triangle”. Our commodity focus is mainly governed by the geological potential of that region. More specifically, the objective is to locate and advance high-quality Cu Au and Li prospects through exploration to discovery.

Corporate

AMEx’s roots grew from the world’s most competitive junior resource industry in Canada. Our most important corporate goal is balancing a healthy budget with sustainable exploration opportunities. Under a responsible fiscal watch, AMEx is committed to adding additional high-quality properties to its portfolio. From a project finance point of view, project venturing through optioning and property transactions to generate cash are the key tactics to providing funding and turning more assets into future exploration opportunities. Adding leverage to pursue several projects at once, AMEx’s strategy also increases the chance of discovery while reducing the risk through a multi-project and commodity portfolio.

As an exploration project operator, we are strongly committed to maintaining our environmental footprint as low as possible by utilizing state-of-the-art exploration tools and technologies and deploying modern data science. Data science technologies offer cost-effective, non-invasive, early-stage tools for successful mineral exploration.

From a corporate perspective, we are selective for reciprocal social value propositions which represent the bottom-line for the company’s engagement.

AMEx is aware of the forceful ecosystems it creates by superposing complex, sometimes conflicting layers of local and international expert-systems, partnerships and interests relative to the company’s prospect generation and exploration efforts. AMEx strives for harvesting the virtuous effects of integration and diversification in mining and exploration-related activities. The creation of sustainable opportunities for growth for the many stakeholders – with particular focus on local communities – beyond the mining-related activities themselves is particularly relevant for us.

Premises:

The supply of minerals and energy are cornerstones of human civilization. While the world population is ever increasing, more people are striving for material stability, better and/or equal opportunities and more affluence for themselves, their families, and the communities they live in. Additionally, with the modern energy paradigm towards a low carbon footprint, the demand for mineral resources is expected to ever increase which translates into a new commodity super-cycle.

AMEx’s commodity focus is mainly governed by the geological potential of the Puna Atacama Altiplano. Our target commodities correlate well with major macro-economic trends. Copper representing the bellwether of the economy is set to play an even more significant role in the global decarbonisation efforts of this century as we expect to fully electrify key spheres of our lives in society around the globe. Lithium also represents a prominent metal in the coming energy storage and electrical vehicle revolution. Gold will retain its ancient value as a world reserve currency and remain an essential component of a balanced investment portfolio still today.

New mining supply will be key to meeting growing global demand, highlighted by decarbonisation efforts. Yet, existing supply depletion combined with decreasing ore grades and increased ESG-risks challenge the world’s ability to find and develop new mineral resources.

Geological processes control the economic concentration of metals and other mineral commodities in the upper crust over geological time. Today, society limits the extractability of economic mineral resources even further by imposing additional regulatory, environmental, and cultural hurdles. Moreover, mineral economics defines economically exploitable reserves. So, our question is, considering the timescale of the mining cycle, where is the next generation of ore deposits to been found, developed, and mined?

Three decades from now, global country risk and tax rules and ESG considerations in mining jurisdictions will have changed in a way we can’t predict today. Although we can expect technology to make additional ore deposits economically accessible in the future, we cannot rely on it. Yet from an explorationists point of view, the only thing that is not going to change in that timeframe is the geological prospectivity of a respective area.

Summary

AMEx selects the Puna Plateau in the Central Andes of South America, an area well known for its rich mineral endowment and favourable geological setting. The region offers an exploration- and mining-friendly cultural environment, a reasonable infrastructure enabling to operate even in remote mountainous terrains. It is important to emphasize the fact that in Argentina the individual provinces control their natural resources. At this point, the selection of the mining jurisdictions (specifically, the Province of Salta and Chile in the case of AMEx) to operate projects becomes relevant because of the competitive advantages those jurisdictions conceal. Salta has been continuously reported by the Canadian Fraser Institute to be one of the top mining jurisdictions in Latin America.

The Puna Plateau Prospective Region hosts significant Cu and Au deposits (Taca Taca, Lindero etc.) and numerous prospects and mineral occurrences with high exploration potential. It also offers open exploration potential when compared to the Eocene-Oligocene belt of northern Chile. The project is surrounded